Compare Home Insurance Quotes

COMPARE HOME INSURANCE QUOTES AND GET REWARDED

Compare up to 50 providers**

Independent and unbiased service*

Enjoy fantastic rewards when you switch through us*

Plus, enjoy fantastic rewards, on us**

97% of reviewers recommend us*

HOW TO COMPARE

Compare home insurance in three easy steps:

Ready to shop around for a better deal? We’ll handle your switch and you can be with your new supplier within five working days:

1. Fill out our quote form.

We’ll need some details about your home, who lives there and if you’re insuring your home’s contents as well as the building itself..

2. We’ll search the market.

We’ll find you the best quotes from 50 trusted insurers, so you can see all your options in one place….

3. Switch and leave the rest to us.

Choose the policy that best suits your needs and complete your purchase on the provider’s website….

4. Relax & Enjoy.

By combining independence with our excellent technology, we can negotiate the best prices and the best value on products and services….

COMPARE HOME INSURANCE

Why should I switch energy supplier?

Your home may well be one of the most expensive purchases you’ll ever make, so it stands to reason that you’re going to want to protect it with the best home insurance policy you can find. However, that doesn’t mean you want to pay over the odds for your home insurance – which is where we come in.

Maryaam.com’s free online home insurance comparison system can help you compare quotes from over 50 different providers in a matter of minutes, making it much more likely that you’ll find a cheap home insurance policy.

:

1. Search up to 50 different home insurance providers .

Quotezone increases your chance of finding a great deal by searching the market for you.

2. Buy online or by phone.

Purchase your home policy quickly and easily, monthly and annual payment options available…

3. You could save time and money.

Get your quotes by filling in one simple form, compare prices, and start saving…

4. Secure & Encrypted.

We guarantee your confidence when shopping online by following the latest internet security standards..

5. Independent and unbiased service.

We aren’t owned by or have any investment from any insurance company..

INSURANCE PROVIDERS

Home nsurance Providers .

We gather quotes and compare prices from 50 UK insurance providers* so you can find the cover you need at the best price.:

how to switch

What do I need to get a home insurance quote?

When you start a home insurance comparison with us, it’s a good idea to have some basic information about your property, including::

Details about your property.

Including the type of property (flat, semi-detached, terrace), roof type, year it was built and number of bedrooms..

The type of policy you want.

Whether it’s combined building and contents, buildings only or contents only.

The rebuild value of your home:-

Find out how to calculate the rebuild cost of your home..

The total value of your home contents:

You’ll need to list any high-value items worth more than £1,500 individually. Find out how to estimate the value of your home contents.

The level of cover you need:

Including how much excess you want to pay and whether you want to add extra cover, such as accidental damage and home emergency cover. .

Your current home insurance policy documents:

We’ll ask you questions to make sure we have all the information we need, including your personal details, to provide you with a list of suitable quotes.

What is home insurance?.

Home insurance (or house insurance) protects your home and its belongings. Depending on your policy, your home and possessions could be covered against damage or loss due to events like fire, flood, storms and theft.

Buildings insurance and contents insurance are the two types of home insurance, and you can choose to buy them separately or combine them into one policy.

HOME INSURANCE

Understanding the types of Home Insurance

There are two types of home insurance cover: buildings insurance and contents insurance. You buy these separately or get both from the same company in a combined house insurance policy..

Buildings insurance –

This could cover the cost of repairing damage to the structure of the property, including the roof and walls. It can also cover any permanent fixtures and fittings, such as windows or kitchen units.

Homeowners and landlords will need this type of insurance.

Contents insurance –

This could cover the possessions inside your home against damage or theft. It typically protects furniture, home appliances, clothes and carpets. It can also cover high-value items in the home, such as jewellery and bicycles.

Anyone with belongings they want to protect should consider this type of insurance.

House and contents insurance–

Combining buildings and contents insurance under one policy from the same provider could make it more convenient if you need to make a claim.

Home and contents insurance can often work out cheaper than taking out separate policies. But you should always compare house insurance quotes to make sure it’s the right option for you.

Who needs home insurance?.

Having buildings and contents insurance could help cover the cost of repairing or rebuilding your home if it’s damaged by a fire, storm or flood, for example. It could also cover the cost of replacing the belongings in your home if they’re stolen, or repairing or replacing them if they’re damaged.

Those who might need home insurance include:

Homeowners –

If you own your home, you’ll be responsible for both the physical structure of your home and any belongings you have on the property.

Students –

If you’re living in student accommodation, you might be covered by a parent or guardian’s home insurance, but this isn’t always the case, so student contents insurance is also an option..

Renters–

If you’re a private tenant in a rental property, you’ll only be responsible for home’s contents – you won’t normally need buildings insurance..

Landlords –

As a landlord, you’ll be legally responsible for the property’s condition, but will only need to cover the building and any contents you provide..

Flat sharers –

If you’re sharing a flat, you’ll normally only need to protect your contents. Details about your living arrangements can affect premiums, as shared households come with certain risks.

Holiday homeowners –

If you own a holiday home that is otherwise unoccupied, you will likely need to take out specialised home insurance for properties that are empty for long periods of time…

How can I get cheaper home insurance?

With the cost of living increasing, There’s a few simple steps you can take to try to reduce your home insurance costs.

Shop around –

Every time your contents and/or buildings insurance policy comes up for renewal, run a new house insurance comparison on sites like Compare the Market. After all, even the best house insurance providers can raise their prices over time.

You may find another provider that can offer you a cheaper policy, but with the same level of cover.

Consider a combined policy–

If you’re looking for value for money, the best home insurance for you could be a combined contents and buildings policy. If you get a combined policy, the provider might give you a discount…

Boost security

Consider adding high-quality locks to your doors and windows, and installing a burglar alarm and smoke alarm.

If you have approved security and safety systems in place, your insurance provider might consider lowering your premium.

Avoid instalments–

If you can afford it, paying your premium upfront in one go usually cuts the cost of home insurance. If you opt to pay in monthly instalments, you might be charged interest on top..

Build up a no-claims discount –

Arguably the best house insurance saving comes from a no-claims discount. If you don’t make a claim on your home insurance, you could be rewarded with a discount on your next premium.

Generally, the longer you go without claiming, the more you can save on your house insurance cost. And you’re likely to be able to carry over the discount if you switch to another insurance provider, so make sure to include this when you get a quote.

.

What does home insurance cover?

The specific level of cover depends on the particulars of your insurance policy. Many house insurance policies will offer similar types of protection, while most will also have certain exclusions..

What does a Home Insurance Policy Cover?–

While basic policies can vary, most cover damage and loss that occurs due to the following causes:

- Fire, lightning, earthquake, explosion

- Subsidence, landslip, or heave

- Storms and floods

- Malicious damage

- Theft of property, or damage caused by attempted theft

- Leaking water tanks and pipes

- Oil leaks from heating systems

- Falling trees or tree branches

- Breakage of TV, radio, or satellite receivers

- Impact from an aircraft, vehicle, or animal

- Riot

For most policies, exclusions are things such as general wear and tear, costs of home maintenance, and damage or breakdown that occurs as a result of poor workmanship.

Most policies also cover a certain amount of personal liability. For example, if someone is injured while in the home and the homeowner is found to be legally responsible, insurance may cover some or all of the compensation and legal costs.

.

Special Coverage and Optional Extras–

By paying a bit more, you can add optional extras to your policy to give you even more protection. You’ll want to keep your policy affordable though, so think carefully about what you need. Add-ons include:

Home insurance providers tend to also offer a wide range of optional coverage. For example:

- Coverage for accidental damage not covered by the standard policy, such as accidental damage caused by the homeowner, or accidental damage of possessions that are taken outside the home.

- Coverage for legal advice and other legal expenses for incidents relating to personal injury disputes, property disputes, and other specified types of disputes.

- Identity theft cover, which provides financial compensation for any costs incurred when reclaiming identity.

- Home emergency cover, for costs associated with repairs and labour. Some policies may also cover accommodation costs if an emergency forces someone to spend the night in a hotel.

Optional extras for your home insurance.

You can choose optional extras or add-ons to your policy to get extra cover for specific scenarios. But remember that they increase the price you pay for your insurance. Before you buy, it’s worth evaluating whether you’re going to use the extra cover. Here are some common home insurance add-ons::

High-value items cover-

This is useful if you own items that are over £1,000. You can list these on your policy as ‘separate items’..

Home emergency cover-

This pays to fix emergency issues or any urgent repairs in your home.

Accidental damage –

If you spill red wine on your cream sofa, accidental damage can cover the cost of repairing or replacing it..

Legal protection –

This can help cover some of the costs if you need to take legal action, for example personal injury claims or disputes about shoddy workmanship.

Personal possessions cover-

This type of policy covers items that are less than £1,000 if they’re damaged, stolen or lost when they’re away from home..

Alternative accommodation–

If your home is uninhabitable after a storm, fire or flooding for example, alternative accommodation cover can give you a place to stay while your home’s being fixed..

Frequently asked questions::

Frequently asked questions.

How can I claim on my home insurance policy?

Can I change my home insurance excess?

Do I get a credit check on a home insurance quote?

Does my credit score affect home insurance?

Having a poor credit score may affect the cost of home insurance. But you should still be able to find an insurance provider with a policy and price that suits you.

When would I need home insurance add-ons?

What kind of door locks do I have?

Only you can answer this. To be sure, you’ll need to compare and identify your door lock against the most common types.

Home insurance providers need to know which types of door lock you have, because some are considered more secure than others.

Five-lever mortice locks are often found on wooden front doors and need a key to lock and open them.

Multi-point locking systems are commonly found on uPVC doors. If you need to lift up the handle to lock the door, you probably have one of these.

Night latches are mounted on the surface of a door, so aren’t as secure as other types of lock. They automatically lock the door when it closes.

Can I get home insurance during building works?

Can I transfer my home insurance policy to a new property?

HOME INSURANCE

Frequently asked questions:

Are my belongings only protected inside the home?

Yes, unless you add personal possessions cover as an extra. This helps protect possessions such as your:

- Mobile phone

- Bags

- Jewellery

Some insurers include this as standard, but you can add it to your contents policy.

This covers items worth less than £1,000 each away from home. You can add cover for high value items worth more than £1,000 or laptops and bikes in your quote.

Can I change my home insurance excess?

Yes. There are 2 kinds of excess – voluntary and compulsory.

As the name suggests, you can’t change your compulsory excess – that’s set by your insurance company. But you can increase or decrease your voluntary excess. In fact, increasing your voluntary excess is one way you could lower your home insurance costs. This does mean you have to pay more if you make a claim.

If you’re worried about how much excess to pay, it’s important to think about what works best with your circumstances. If you can afford to pay a higher excess in the event of a claim it could lower the cost of your insurance policy, saving you money.

Can I get home insurance if I live in a flood risk area?

Yes, flood insurance is usually covered in most home insurance policies but it’s worth checking the finer details with your provider.

The ABI (Association of British Insurers) launched the Flood Re. scheme in 2016, to help those living in flood risk areas find affordable home insurance. The scheme estimates that hundreds of thousands of UK homes could be harder to insure due to being at high risk from flooding. All home insurance providers in the UK pay into the scheme, with the money raised used to cover homes at risk of flooding.

Will my credit score affect my home insurance?

Your credit score shouldn’t impact the price you pay for your home insurance. Insurers look at your credit score to:

- Check your financial profile

- Verify your identity to help prevent fraud

- Provide you with their best price and payment options

Equally, getting a home insurance quote shouldn’t impact your credit score. You might see ‘soft searches’ on your credit report but these are nothing to worry about. They’re only visible to you and don’t affect your credit rating.

The only time you’ll see a ‘hard’ search is if you choose to pay for your home insurance monthly. This is because the insurer needs to check you can cover the payments of the contract, usually over 12 months.

Does home insurance cover roof leaks?

Home insurance covers roof leaks if you have home emergency cover. Cover for roof damage can be included as standard with some insurers but always check your policy details to be sure.

If finding the source of a leak proves to be more difficult than first thought, trace and access cover could help. This means finding out where a potential leak is coming from. It’s included in most home insurance policies.

How much cover do I need?

The amount of cover you need to be fully protected largely depends on two factors:

- The rebuild cost of your house

- The total value of your possessions

Your homes rebuild cost is different to its current market value. A house that’s worth £200,000 might only cost £150,000 to rebuild, for example. Overestimating this amount could increase your home insurance costs. We’ll estimate this cost for you when you get a quote.

When working out the value of your contents, think of everything you’d have to replace if the entire house was gone. This includes:

- All gadgets and electronics

- All clothes and jewellery

- All furniture

- All books, CDs, DVDs, games, toys and musical instruments

- The food in your cupboards, fridge and freezer

HOME INSURANE GUIDE

A simples guide to home insurance.

WORDS OF CEO

The Best Construction With Design Consistency.

Lorem ipsum volutpat dolor sit amet, consectetur adipiscing elit. Aliquam ornare id est iaculis rhodncus. Aliquam quis suscipit eniim. Duis nam ferientum velit egestas tellus lobortis pharetra. Maecenas consequat volutpat velit.

Benjamin Doe

CEO of company

ALIQUAM ORNARE

Construction & engineering real solutions

Lorem ipsum volutpat dolor sit amet, consectetur adipiscing elit. Aliquam ornare id Maecenas consequat volutpat velit. Phasellus rhoncus eget metus enim est iaculis rhodncus. Aliquam quis suscipit eniim. Duis nam ferientum vitaevelit egestas tellus lobortis pharetra. Maecenas consequat volutpat velit.

Car Insurance Providers

Bike Insurance Providers

Home Insurance Providers

Broadband Providers

FREQUENTLY ANSWERS

Frequently Asked Questions

Classic car

There’s no one definition of a classic car, but insurance providers consider it to be one that’s at least 15 years old.

We can help you find car insurance cover for your classic, provided it was manufactured from 1970 onwards.

Classic car

There’s no one definition of a classic car, but insurance providers consider it to be one that’s at least 15 years old.

We can help you find car insurance cover for your classic, provided it was manufactured from 1970 onwards.

Classic car

There’s no one definition of a classic car, but insurance providers consider it to be one that’s at least 15 years old.

We can help you find car insurance cover for your classic, provided it was manufactured from 1970 onwards.

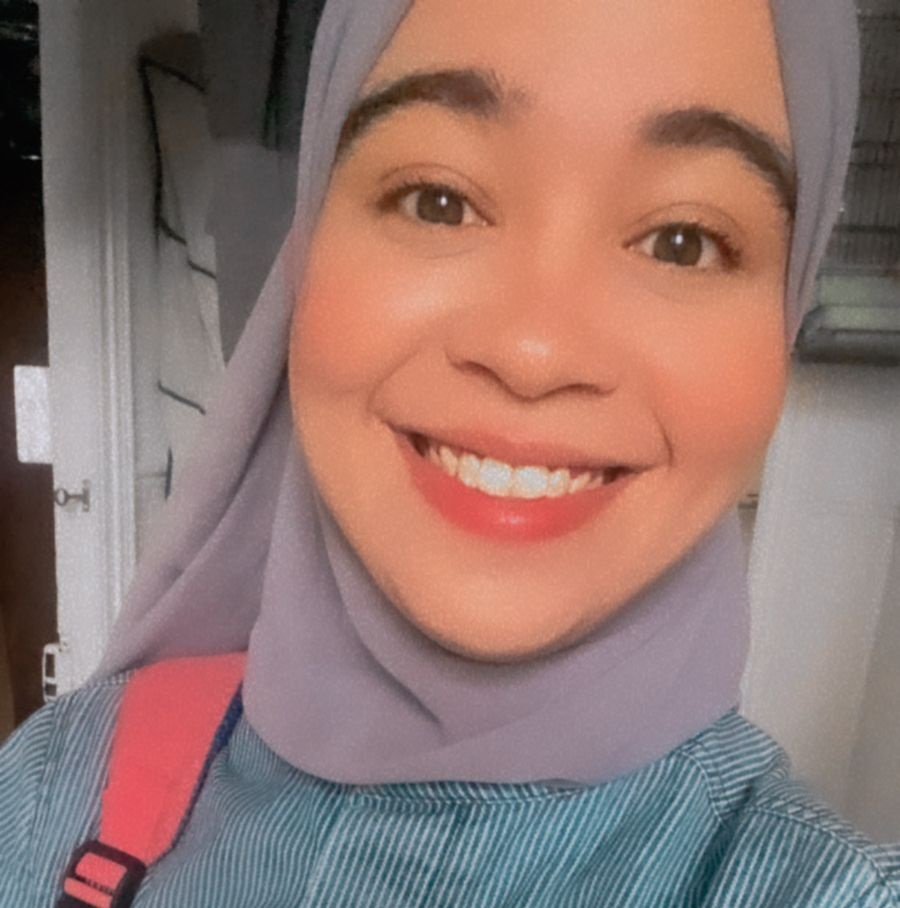

TESTIMONIAL

Know About us from lovely and special Clients

we can help with more than just car insurance, you’ll be pleased to know. In fact, our clever comparison technologies can help you find truly great deals on different insurance and financial services products, from van insurance to motorbike insurance, home insurance to Energy and Broadband Providers.

- Insurance 85%

- Energy 80%

- Broadband 95%

"Best and Fast Services Highly Recommended"

''The customer service was very helpful and friendly. My order arrived on time and in perfect condition. The ..."Lorem ipsum dolorit amet"

Adipiscing elit maecenas vel egestas leo borbi non sollicdin nisi vurabitur id lectus ut ligula iaculis laoreet tincidunt ..."Best Quality Services"

Adipiscing elit maecenas vel egestas leo borbi non sollicdin nisi vurabitur id lectus ut ligula iaculis laoreet tincidunt eget ...

"Used Quality products"

Adipiscing elit maecenas vel egestas leo borbi non sollicdin nisi vurabitur id lectus ut ligula iaculis laoreet tincidunt eget lorem. Nam ..."Excellent Work"

Adipiscing elit maecenas vel egestas leo borbi non sollicdin nisi vurabitur id lectus ut ligula iaculis laoreet tincidunt eget lorem. ...